|

|

import gradio as gr |

|

|

|

|

|

from classify import judge |

|

|

from entity import resolve |

|

|

from graphrag import marketingPlan |

|

|

from human import email, feedback |

|

|

from knowledge import graph |

|

|

from pii import derisk |

|

|

from rag import rbc_product |

|

|

from tool import rival_product |

|

|

from multi import bestPractice |

|

|

import os |

|

|

os.system("pip freeze | tee requirements_log.txt") |

|

|

|

|

|

|

|

|

head = """ |

|

|

<!-- Google tag (gtag.js) --> |

|

|

<script async src="https://www.googletagmanager.com/gtag/js?id=G-SRX9LDVBCW"></script> |

|

|

<script> |

|

|

window.dataLayer = window.dataLayer || []; |

|

|

function gtag(){dataLayer.push(arguments);} |

|

|

gtag('js', new Date()); |

|

|

|

|

|

gtag('config', 'G-SRX9LDVBCW'); |

|

|

</script> |

|

|

|

|

|

<!-- Default Statcounter code for kevinhug/ai |

|

|

https://huggingface.co/spaces/kevinhug/ai --> |

|

|

<script type="text/javascript"> |

|

|

var sc_project=13123186; |

|

|

var sc_invisible=1; |

|

|

var sc_security="c78c54ad"; |

|

|

</script> |

|

|

<script type="text/javascript" |

|

|

src="https://www.statcounter.com/counter/counter.js" |

|

|

async></script> |

|

|

<noscript><div class="statcounter"><a title="Web Analytics" |

|

|

href="https://statcounter.com/" target="_blank"><img |

|

|

class="statcounter" |

|

|

src="https://c.statcounter.com/13123186/0/c78c54ad/1/" |

|

|

alt="Web Analytics" |

|

|

referrerPolicy="no-referrer-when-downgrade"></a></div></noscript> |

|

|

<!-- End of Statcounter Code --> |

|

|

|

|

|

<div id="sfclluw49qah2u3f45m49z5c2k3x3h8p458"></div><script type="text/javascript" src="https://counter2.optistats.ovh/private/counter.js?c=lluw49qah2u3f45m49z5c2k3x3h8p458&down=async" async></script><br><a href="https://www.freecounterstat.com">web page counter code</a><noscript><a href="https://www.freecounterstat.com" title="web page counter code"><img src="https://counter2.optistats.ovh/private/freecounterstat.php?c=lluw49qah2u3f45m49z5c2k3x3h8p458" border="0" title="web page counter code" alt="web page counter code"></a></noscript> |

|

|

<!-- End of https://www.freecounterstat.com/geozoom.php?c=lluw49qah2u3f45m49z5c2k3x3h8p458&base=counter2 Code --> |

|

|

|

|

|

<script> |

|

|

fetch('https://ipapi.co/json/') |

|

|

.then(response => response.json()) |

|

|

.then(data => { |

|

|

if (data.country_code === 'IN') { |

|

|

document.body.innerHTML = "<h1>Server Denied</h1><p>Sorry, Server Error.</p>"; |

|

|

} |

|

|

}) |

|

|

.catch(error => { |

|

|

console.error('GeoIP lookup failed:', error); |

|

|

}); |

|

|

</script> |

|

|

""" |

|

|

|

|

|

with gr.Blocks(head=head) as demo: |

|

|

with gr.Tab("Intro"): |

|

|

gr.Markdown(""" |

|

|

If you're experiencing declining market share, inefficiencies in your operations, here's how I can help: |

|

|

============== |

|

|

Marketing & Client Experience |

|

|

------------ |

|

|

- GraphRAG: Models customer-product relationship networks for next-best-action predictions |

|

|

- DSPy: Optimizes cross-sell/upsell prompt variations through A/B testing |

|

|

|

|

|

Risk & Audit |

|

|

------------ |

|

|

- GraphRAG: Maps transactional relationships into dynamic knowledge graphs to detect multi-layered fraud patterns |

|

|

- Tool Use: Integrates fraud detection APIs, anomaly scoring models, and regulatory compliance checkers |

|

|

- DSPy: Optimizes fraud explanation prompts for regulatory reporting |

|

|

- Explainable AI: Intuitive visualization to help stakeholder understand model risk and flaw |

|

|

|

|

|

Other Links: |

|

|

------------ |

|

|

- https://huggingface.co/spaces/kevinhug/clientX |

|

|

- https://kevinwkc.github.io/davinci/ |

|

|

""") |

|

|

|

|

|

with gr.Tab("Tool Use Competitive Research"): |

|

|

gr.Markdown(""" |

|

|

Objective: Persona-Driven Financial Product Recommendations: Unlock Competitive Advantage & Feature Innovation |

|

|

================================================ |

|

|

- Retrieval: Public Product Data using Tavily Search |

|

|

- Recommend: Competition Product |

|

|

|

|

|

### benefits |

|

|

- remove friction in research, saving labour time |

|

|

- improve insight quality by identify competitor |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Verbatim") |

|

|

out_product = gr.Textbox(label="Product") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

"Low APR and great customer service. I would highly recommend if you’re looking for a great credit card company and looking to rebuild your credit. I have had my credit limit increased annually and the annual fee is very low."] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Recommend") |

|

|

btn_recommend.click(fn=rival_product, inputs=in_verbatim, outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

Example Output |

|

|

========== |

|

|

The U.S. Bank Cash+ Visa Secured Card, Capital One Quicksilver Secured Cash Rewards Credit Card, and Bank of America Customized Cash Rewards Secured Credit |

|

|

Card are all options that may meet the customer's requirements. |

|

|

|

|

|

Companies in competitive industries are constantly under pressure to innovate—but often face the same challenge: |

|

|

================== |

|

|

### 📉 Pain points: |

|

|

- Unable to identify gaps or opportunities in competitor products in real-time. |

|

|

- Lack of insight into customer feedback on competitor features. |

|

|

- Difficulty in predicting how new features will be received in the market. |

|

|

|

|

|

## 🧩 The real question: |

|

|

How can your product stay ahead of the competition without a clear understanding of what features your competitors are developing, and how they’re performing with customers? |

|

|

|

|

|

### 🎯 The customer need: |

|

|

What businesses really need is a data-driven approach to **competitor product research**, one that can identify trends, uncover feature gaps, and provide actionable insights to drive innovation in product development. |

|

|

|

|

|

## ✅ Solution: **Competitor Product Research for Feature Development** |

|

|

|

|

|

By leveraging AI, market intelligence, and competitive analysis tools, you can track competitor launches, analyze user sentiment, and evaluate feature performance across the board. This insight helps shape strategic product decisions—ensuring your team isn't building in the dark. |

|

|

|

|

|

### 📌 Real-world use cases: |

|

|

- **Spotify** tracks competitor music features, leveraging insights from users and music trends to introduce features like playlist sharing and collaborative playlists—leading to increased user engagement. |

|

|

- **Apple** regularly conducts competitor analysis to anticipate and outpace trends, such as implementing health tracking features before they became mainstream in wearables. |

|

|

- **Slack** uses competitor research to build features that cater to the evolving needs of remote teams, like advanced search functionality and integrations with other tools. |

|

|

|

|

|

### 💡 Business benefits: |

|

|

- **Informed product decisions**: Develop features that fill gaps and add value in ways competitors aren’t addressing. |

|

|

- **Faster time-to-market**: Avoid reinventing the wheel by learning from competitors’ successes and mistakes. |

|

|

- **Market positioning**: Stay one step ahead of competitors, ensuring your product remains the best solution for your target audience. |

|

|

|

|

|

With the right competitive research, you don’t just react to the market—you anticipate it. |

|

|

""") |

|

|

|

|

|

with gr.Tab("Multi Agent"): |

|

|

|

|

|

in_verbatim = gr.Textbox(label="Application Security Best Practice on Topic") |

|

|

out_product = gr.Textbox(label="Best Practice") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

|

|

|

"Docker Containers", "REST API", "Python" |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Research (Diabled used up all the token for LLM quota)", interactive=False) |

|

|

btn_recommend.click(fn=bestPractice, inputs=in_verbatim, outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

Example Output |

|

|

============= |

|

|

Based on the provided information from both researchers and security experts, we now have a comprehensive guide on understanding and effectively using Dock |

|

|

er containers in modern software development. Here's a summary: |

|

|

|

|

|

### Understanding Docker Containers |

|

|

|

|

|

- **Overview**: Docker containers provide an efficient way to package applications along with their dependencies into lightweight, portable units. |

|

|

- **Components**: |

|

|

- **Architecture**: Docker containers leverage the host system’s kernel, allowing for resource isolation and minimal overhead. |

|

|

- **Features**: Supports microservices architecture, CI/CD pipelines, development environment consistency, and more. |

|

|

|

|

|

### Best Practices |

|

|

|

|

|

1. **Use Official Images** |

|

|

- Use official images from trusted sources like Docker Hub to minimize security risks. |

|

|

2. **Keep Your Containers Up-to-Date** |

|

|

- Regularly update your container images to include the latest security patches and bug fixes. |

|

|

3. **Limit Privileges** |

|

|

- Run containers with minimal privileges to reduce potential damage in case of a compromise. |

|

|

4. **Use Volumes Wisely** |

|

|

- Be cautious when using volumes, especially for sensitive data. |

|

|

5. **Secure Network Access** |

|

|

- Configure network settings carefully to prevent unauthorized access. |

|

|

6. **Implement Logging and Monitoring** |

|

|

- Set up logging and monitoring to detect unusual activity early. |

|

|

7. **Regularly Test Your Containers** |

|

|

- Periodically test your containerized applications using security scans. |

|

|

|

|

|

### Common Pitfalls |

|

|

|

|

|

1. **Using Untrusted Images** |

|

|

- Only use official or trusted images and verify their integrity. |

|

|

2. **Running Containers as Root** |

|

|

- Avoid running containers with root privileges to limit potential risks. |

|

|

3. **Exposing Sensitive Data Through Volumes** |

|

|

- Properly manage data volumes to ensure sensitive information is not exposed. |

|

|

4. **Poor Network Configuration** |

|

|

- Use Docker networks and firewalls to restrict network traffic. |

|

|

5. **Lack of Logging and Monitoring** |

|

|

- Implement robust logging strategies using tools like `docker logs` or centralized log management systems. |

|

|

|

|

|

### Conclusion |

|

|

|

|

|

By adhering to these best practices and being aware of common pitfalls, you can significantly enhance the security and efficiency of your Docker container |

|

|

deployments. This guide should serve as a comprehensive reference for both new and experienced users looking to leverage Docker effectively in their projec |

|

|

ts. |

|

|

|

|

|

If there are any specific aspects or components you'd like further details on, feel free to ask! |

|

|

|

|

|

|

|

|

The faster we build, the higher the risk of introducing vulnerabilities—especially in applications tied to personal banking workflows, where financial fraud can directly impact customer trust. |

|

|

===================== |

|

|

Yet most security tools today are reactive, slow, and generic—they don't reflect specific infrastructure, threat profile, or code patterns. |

|

|

|

|

|

So here’s the core question we should be asking: |

|

|

|

|

|

How can we turn application security from a bottleneck into a competitive advantage—one that provides developers with fast, context-aware, and proactive feedback tailored to unique environment? |

|

|

|

|

|

### ✅ Reframed Customer Need |

|

|

- Developers want actionable feedback during the build process—not after deployment. |

|

|

|

|

|

- Security teams need to detect and explain vulnerabilities in specific patterns—across containers, APIs, and legacy integrations. |

|

|

|

|

|

Product & revenue teams need confidence that customer-facing banking apps will not just ship fast—but also protect users and unlock new monetization opportunities. |

|

|

|

|

|

### 💡 Proposed Solution |

|

|

Agent Design Pattern: https://x.com/i/status/1940342200216482211 |

|

|

General System Design: https://pbs.twimg.com/media/FuKyiRIaAAEbC5B?format=jpg&name=900x900 |

|

|

|

|

|

A multi-agent GenAI system trained on RBC’s codebase, policy docs, and threat data— |

|

|

that provides real-time, localized security feedback, explains why something’s a risk, and suggests secure-by-default alternatives. |

|

|

|

|

|

Agents include: |

|

|

- Code risk explainer agent: Detects common security flaws (e.g., insecure API calls) and provides context-specific impact analysis. |

|

|

|

|

|

- Infrastructure policy checker agent: Validates use of containers and deployment patterns against RBC’s internal compliance standards. |

|

|

|

|

|

- Refactor assistant agent: Suggests how to fix the issue, with references to existing secure modules. |

|

|

""") |

|

|

|

|

|

with gr.Tab("Graphrag Marketing"): |

|

|

gr.Markdown(""" |

|

|

Objective: Develop a Targeted Marketing Plan Aligned with Customer Personas |

|

|

======================= |

|

|

- Reasoning from context, answering the question |

|

|

""") |

|

|

|

|

|

marketing = """ |

|

|

A business model is not merely a static description but a dynamic ecosystem defined by five interdependent pillars: |

|

|

|

|

|

Value Creation (What you sell): The core offering must solve a critical pain point or unlock untapped demand. This is the foundation of your value proposition—quantifiable (e.g., cost efficiency) or qualitative (e.g., exceptional user experience)—that differentiates you in the market. |

|

|

|

|

|

Delivery Infrastructure (How you deliver): Channels and partnerships must align to ensure seamless access to your offering. For instance, a SaaS company might leverage cloud platforms for instant scalability, while a luxury brand prioritizes exclusive retail partnerships. |

|

|

|

|

|

Customer Lifecycle Dynamics: |

|

|

|

|

|

Acquisition: How do users discover you? Channels like organic search (SEO), targeted ads, or influencer partnerships must map to your customer segments’ behaviors. |

|

|

|

|

|

Activation: Do first-time users experience immediate value? A fitness app, for example, might use onboarding tutorials to convert sign-ups into active users. |

|

|

|

|

|

Retention: Is engagement sustained? Metrics like churn rate and CLV reveal whether your model fosters loyalty through features like personalized content or subscription perks. |

|

|

|

|

|

Referral: Do users become advocates? Incentivize sharing through referral programs or viral loops (e.g., Dropbox’s storage rewards). |

|

|

|

|

|

Revenue Architecture (How you monetize): Align pricing models (subscriptions, freemium tiers) with customer willingness-to-pay. For instance, a niche market might sustain premium pricing, while a mass-market product prioritizes volume. |

|

|

|

|

|

Cost Symmetry: Every activity—from R&D to customer support—must balance against revenue streams. A low-cost airline, for example, optimizes for operational efficiency to maintain profitability. |

|

|

|

|

|

Strategic Imperatives for Modern Business Models |

|

|

|

|

|

Systemic Integration: Ohmae’s “3C’s” (Customer, Competitor, Company) remind us that acquisition channels and value propositions must adapt to shifting market realities. For instance, a retailer might pivot from brick-and-mortar to hybrid models post-pandemic. |

|

|

|

|

|

Data-Driven Iteration: Use AARRR metrics to identify leaks in the funnel. If activation rates lag, refine onboarding; if referrals stagnate, enhance shareability. |

|

|

|

|

|

Scalability through Partnerships: Key partners (e.g., tech vendors, logistics providers) can reduce overhead while expanding reach—critical for transitioning from niche to mass markets. |

|

|

|

|

|

By framing each component as a strategic variable rather than a fixed element, businesses can continuously adapt to disruptions—a necessity in Ohmae’s vision of fluid, customer-first strategy. |

|

|

""" |

|

|

in_verbatim = gr.Textbox(label="Context", value=marketing, visible=False) |

|

|

in_question = gr.Textbox(label="Persona") |

|

|

out_product = gr.Textbox(label="Plan") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

""" |

|

|

Low APR and great customer service. I would highly recommend if you’re looking for a great credit card company and looking to rebuild your credit. I have had my credit limit increased annually and the annual fee is very low. |

|

|

"""] |

|

|

], |

|

|

[in_question] |

|

|

) |

|

|

btn_recommend = gr.Button("Reasoning") |

|

|

btn_recommend.click(fn=marketingPlan, inputs=[in_verbatim, in_question], outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

Example Output |

|

|

============== |

|

|

To create a marketing campaign that improves customer acquisition, activation, retention, and referral for the given persona, I'll outline a strategy based on the provided information. |

|

|

|

|

|

**Campaign Name:** "Rebuild with Confidence" |

|

|

|

|

|

**Objective:** To attract individuals looking to rebuild their credit, provide excellent customer service, and offer competitive APRs, ultimately increasing customer loyalty and referrals. |

|

|

|

|

|

**Target Audience:** Individuals with poor or fair credit scores, seeking to rebuild their credit and enjoy low APRs and great customer service. |

|

|

|

|

|

**Customer Acquisition:** |

|

|

|

|

|

1. **Social Media Campaigns:** Utilize platforms like Facebook, Instagram, and Twitter to target individuals with poor or fair credit scores. Create engaging ads highlighting the benefits of rebuilding credit with our credit card company. |

|

|

2. **Influencer Partnerships:** Collaborate with personal finance influencers and bloggers to promote our credit card company as a reliable option for credit rebuilding. |

|

|

3. **Online Advertising:** Run targeted Google Ads and sponsored content on websites focused on personal finance, credit repair, and rebuilding credit. |

|

|

|

|

|

**Customer Activation:** |

|

|

|

|

|

1. **Welcome Package:** Send a personalized welcome package to new customers, including a comprehensive guide to rebuilding credit, a credit score tracker, and a dedicated customer service contact. |

|

|

2. **Onboarding Process:** Implement a seamless onboarding process, ensuring new customers can easily activate their credit card and start using it to rebuild their credit. |

|

|

3. **Education and Resources:** Provide access to educational resources, such as webinars, videos, and blog posts, to help customers understand credit rebuilding strategies and best practices. |

|

|

|

|

|

**Customer Retention:** |

|

|

|

|

|

1. **Regular Communication:** Send regular updates on customers' credit score progress, highlighting their achievements and offering tips for continued improvement. |

|

|

2. **Annual Credit Limit Increases:** Continue to increase customers' credit limits annually, as mentioned in the persona's review, to demonstrate our commitment to their credit rebuilding journey. |

|

|

3. **Exclusive Offers:** Provide exclusive offers and promotions to loyal customers, such as reduced APRs or special rewards programs. |

|

|

|

|

|

**Customer Referral:** |

|

|

|

|

|

1. **Referral Program:** Launch a referral program that rewards customers for referring friends and family who successfully rebuild their credit with our credit card company. |

|

|

2. **Social Proof:** Encourage satisfied customers to share their positive experiences on social media, using a branded hashtag to track and showcase their success stories. |

|

|

3. **Incentives:** Offer incentives, such as cash rewards or premium benefits, to customers who refer multiple friends and family members who successfully rebuild their credit. |

|

|

|

|

|

**Budget Allocation:** |

|

|

|

|

|

1. **Social Media and Influencer Marketing:** 30% |

|

|

2. **Online Advertising:** 25% |

|

|

3. **Welcome Package and Onboarding Process:** 15% |

|

|

4. **Education and Resources:** 10% |

|

|

5. **Referral Program and Incentives:** 10% |

|

|

|

|

|

**Timeline:** |

|

|

|

|

|

1. **Month 1-3:** Launch social media campaigns, influencer partnerships, and online advertising. |

|

|

2. **Month 4-6:** Implement welcome package and onboarding process, and begin providing education and resources. |

|

|

3. **Month 7-9:** Launch referral program and incentives. |

|

|

4. **Month 10-12:** Analyze results, adjust strategies, and plan for future campaigns. |

|

|

|

|

|

By following this campaign strategy, we can effectively attract and retain customers who are looking to rebuild their credit, while also encouraging referrals and promoting our credit card company as a trusted and reliable option. |

|

|

|

|

|

Benefits of a Marketing Campaign Generator |

|

|

=============== |

|

|

- Accelerated Campaign Launches |

|

|

Quickly generates tailored campaigns, reducing go-to-market time from weeks to hours. |

|

|

|

|

|

- Improved Targeting & Personalization |

|

|

Uses customer data and behavior to craft messages that resonate with specific segments. |

|

|

""") |

|

|

|

|

|

with gr.Tab("Personalized KG"): |

|

|

gr.Markdown(""" |

|

|

Objective: Transform Personal Pain Points into Actionable Insights with a Dynamic Knowledge Graph Framework |

|

|

===================================== |

|

|

- Identify what channel customer prefer |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Question") |

|

|

out_product = gr.JSON(label="Knowledge Graph") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

""" |

|

|

Representative: "Thank you for calling Goldman Sachs Credit Card Services. My name is Sarah. May I have your full name and the last 4 digits of your card number for verification?" |

|

|

|

|

|

Customer: "This is Michael Chen, card ending 5402." |

|

|

|

|

|

Representative: "Thank you, Mr. Chen. I show you have an Apple Card account opened in 2023. How can I assist you today?" (Reference: Search Result Apple Card context) |

|

|

|

|

|

Customer: "I'm disputing a $329 charge from TechElectronics from March 15th. I never received the item." |

|

|

|

|

|

Representative: "I understand your concern. Let me initiate a dispute investigation. Per our process (Search Result BBB complaint handling): |

|

|

|

|

|

We'll apply a temporary credit within 24 hours |

|

|

|

|

|

Our team will contact the merchant |

|

|

|

|

|

You'll receive email updates at michael.chen@email.com |

|

|

|

|

|

Final resolution within 60 days |

|

|

|

|

|

Would you like me to proceed?" |

|

|

|

|

|

Customer: "Yes, but what if they fight it?" |

|

|

|

|

|

Representative: "If the merchant disputes your claim, we'll: |

|

|

|

|

|

Review all evidence using our 3-phase verification system (Search Result multi-stage investigation) |

|

|

|

|

|

Consider your purchase protection benefits |

|

|

|

|

|

Escalate to senior specialists if needed |

|

|

|

|

|

For security, never share your CVV (339) or full card number with callers. Always call back using the number on your physical card (Search Result scam warning)." |

|

|

|

|

|

Customer: "Can I make a partial payment on my balance while this is pending?" |

|

|

|

|

|

Representative: "Absolutely. We offer: |

|

|

"minimum_payment": "$35 due April 25", |

|

|

"hardship_program": "0% APR for 6 months", |

|

|

"custom_plan": "Split $600 balance over 3 months" |

|

|

Would you like to enroll in any of these?" |

|

|

|

|

|

Customer: "The 3-month plan, please." |

|

|

|

|

|

Representative: "Confirmed. Your next payment of $200 will process May 1st. A confirmation email with dispute case #GS-2025-0422-8830 is being sent now. Is there anything else?" |

|

|

|

|

|

Customer: "No, thank you." |

|

|

""" |

|

|

] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Graph It!") |

|

|

btn_clear = gr.ClearButton(components=[out_product]) |

|

|

btn_recommend.click(fn=graph, inputs=[in_verbatim, out_product], outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

Example Output |

|

|

============== |

|

|

``` |

|

|

{'edges': [{'color': 'black', 'label': 'hasAccount', 'source': 1, 'target': 2}, |

|

|

{'color': 'black', |

|

|

'label': 'disputeCaseIsFor', |

|

|

'source': 1, |

|

|

'target': 5}, |

|

|

{'color': 'black', 'label': 'causedBy', 'source': 3, 'target': 4}, |

|

|

{'color': 'black', |

|

|

'label': 'hasChargeDispute', |

|

|

'source': 2, |

|

|

'target': 4}], |

|

|

'nodes': [{'color': 'orange', |

|

|

'id': 4, |

|

|

'label': '$329 Charge Dispute', |

|

|

'record_date': datetime.date(2023, 3, 15)}, |

|

|

{'color': 'orange', |

|

|

'id': 2, |

|

|

'label': 'Apple Card', |

|

|

'record_date': datetime.date(2023, 4, 5)}, |

|

|

{'color': 'orange', |

|

|

'id': 5, |

|

|

'label': 'GS-2025-0422-8830', |

|

|

'record_date': datetime.date(2023, 4, 5)}, |

|

|

{'color': 'orange', |

|

|

'id': 3, |

|

|

'label': 'TechElectronics', |

|

|

'record_date': datetime.date(2023, 3, 15)}, |

|

|

{'color': 'orange', |

|

|

'id': 1, |

|

|

'label': 'Michael Chen', |

|

|

'record_date': datetime.date(2023, 4, 5)}]} |

|

|

|

|

|

``` |

|

|

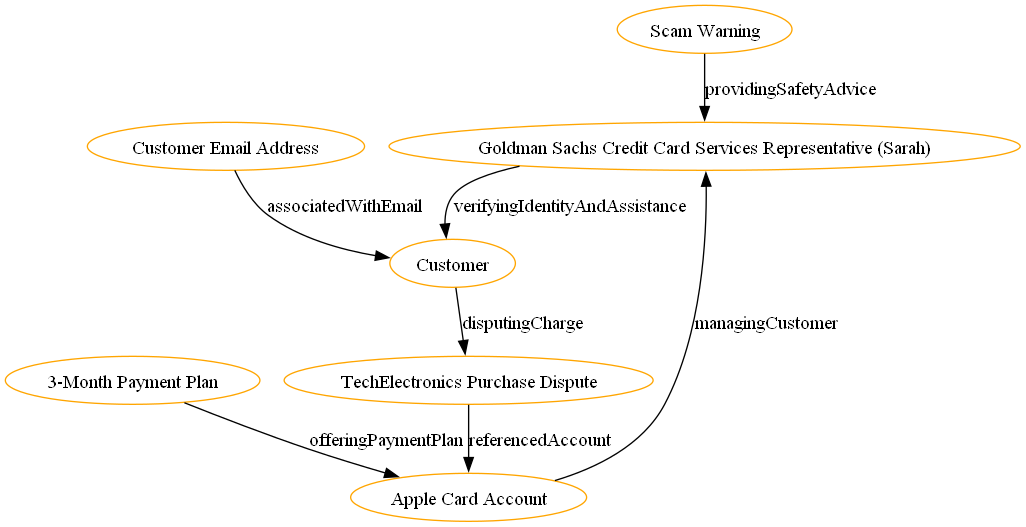

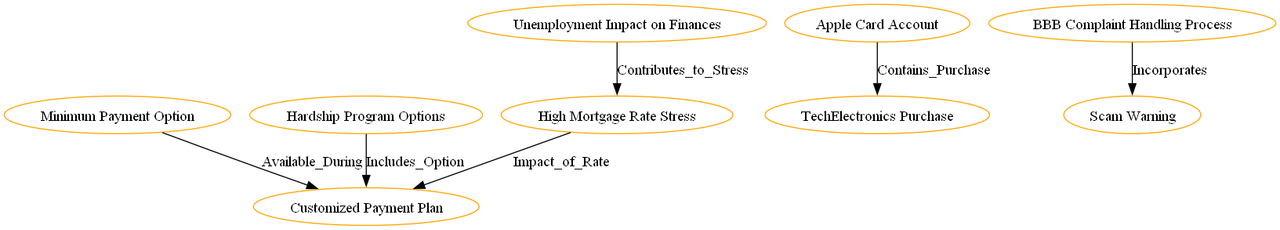

Example of Customer Profile in Graph |

|

|

================= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#### Customer Needs and Pain Points |

|

|

https://i.postimg.cc/D03Sstqd/knowledge-graph1.png |

|

|

#### Accumulated Interaction for the same Customer Needs and Pain Points |

|

|

https://i.postimg.cc/9ffZQ5pD/knowledge-graph2.png |

|

|

|

|

|

Benefits of a Knowledge Graph |

|

|

============ |

|

|

- Smarter Data Relationships |

|

|

Connects siloed data across domains to create a holistic, contextual view. |

|

|

|

|

|

- Improved Search & Discovery |

|

|

Enables semantic search—understanding meaning, not just keywords. |

|

|

|

|

|

- Enhanced Decision-Making |

|

|

Surfaces hidden patterns and relationships for better analytics and insights. |

|

|

|

|

|

- Data Reusability |

|

|

Once created, knowledge graphs can be repurposed across multiple use cases (e.g., search, recommendation, fraud detection). |

|

|

""") |

|

|

|

|

|

with gr.Tab("Segmentation"): |

|

|

gr.Markdown(""" |

|

|

Objective: Streamline Customer Insights: Auto-Classify Feedback for Product Optimization |

|

|

================================================ |

|

|

- multi class classification, could have multiple label for 1 feedback |

|

|

- fix classification in this use case: online banking, card, auto finance, mortgage, insurance |

|

|

- LLM Judge to evaluate relevancy |

|

|

|

|

|

Business use case: customer segmentation for ab testing |

|

|

------------------------------------------------ |

|

|

- Acquisition: Behavior cluster, we can predict not only who is likely to click—but who is likely to retain |

|

|

- Activation: segmenting users based on behavioral signals—like browsing activity, time since last engagement, or declining open/click rates. |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Customer Feedback separate by ;") |

|

|

out_product = gr.Textbox(label="Classification & Evaluation") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

""" |

|

|

"The online portal makes managing my mortgage payments so convenient."; |

|

|

"RBC offer great mortgage for my home with competitive rate thank you"; |

|

|

"Low interest rate compared to other cards I’ve used. Highly recommend for responsible spenders."; |

|

|

"The mobile check deposit feature saves me so much time. Banking made easy!"; |

|

|

"Affordable premiums with great coverage. Switched from my old provider and saved!" |

|

|

""" |

|

|

] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Classify & Evaluation") |

|

|

btn_recommend.click(fn=judge, inputs=in_verbatim, outputs=out_product) |

|

|

gr.Markdown(""" |

|

|

Example Output |

|

|

=========== |

|

|

``` |

|

|

{ |

|

|

"texts": [ |

|

|

"\"The online portal makes managing my mortgage payments so convenient.\"", |

|

|

"\"RBC offer great mortgage for my home with competitive rate thank you\"", |

|

|

"\"Low interest rate compared to other cards I’ve used. Highly recommend for responsible spenders.\"", |

|

|

"\"The mobile check deposit feature saves me so much time. Banking made easy!\"", |

|

|

"\"Affordable premiums with great coverage. Switched from my old provider and saved!\"" |

|

|

], |

|

|

"predictions": [ |

|

|

[ |

|

|

{ |

|

|

"chain_of_thought": [ |

|

|

"The customer mentions managing mortgage payments online, which directly relates to the 'online' tag.", |

|

|

"There is no mention or implication of card, cars, insurance, or any other tags in the text." |

|

|

], |

|

|

"name": "online", |

|

|

"id": 0, |

|

|

"confidence": 1.0 |

|

|

} |

|

|

], |

|

|

[ |

|

|

{ |

|

|

"chain_of_thought": [ |

|

|

"The customer explicitly mentions 'mortgage for my home', which directly corresponds to the tag name 'mortgage'.", |

|

|

"There is no mention of online, card, cars, or insurance in the text.", |

|

|

"Therefore, we can confidently apply the mortgage tag." |

|

|

], |

|

|

"name": "mortgage", |

|

|

"id": 3, |

|

|

"confidence": 1.0 |

|

|

} |

|

|

], |

|

|

[ |

|

|

{ |

|

|

"chain_of_thought": [ |

|

|

"The customer mentions a low interest rate and compares it to other cards they have used. This indicates the text is related to a card product.", |

|

|

"There is no mention of online services, cars, mortgage, or insurance in the text." |

|

|

], |

|

|

"name": "card", |

|

|

"id": 1, |

|

|

"confidence": 0.9 |

|

|

} |

|

|

], |

|

|

[ |

|

|

{ |

|

|

"chain_of_thought": [ |

|

|

"The customer explicitly mentions the mobile check deposit feature which is related to online banking services.", |

|

|

"There is a Tag with id 0 named 'online' that matches the content of the text." |

|

|

], |

|

|

"name": "online", |

|

|

"id": 0, |

|

|

"confidence": 1.0 |

|

|

} |

|

|

], |

|

|

[ |

|

|

{ |

|

|

"chain_of_thought": [ |

|

|

"The customer mentions 'premiums' and 'coverage', which are related to insurance products. There is a tag named 'insurance' with id 4, so we can |

|

|

tag this text with 'insurance'.", |

|

|

"There's no mention of online services, cards, cars, or mortgages in the text." |

|

|

], |

|

|

"name": "insurance", |

|

|

"id": 4, |

|

|

"confidence": 0.9 |

|

|

} |

|

|

] |

|

|

], |

|

|

"judgment": [ |

|

|

[ |

|

|

{ |

|

|

"thought": "The reasoning states that the customer mentioned managing mortgage payments online. The answer provided is 'online'. Since the context |

|

|

explicitly stated that the topic was about online management, it logically follows that 'online' would be the correct and relevant response.", |

|

|

"justification": "The reasoning directly connects the mention of 'managing mortgage payments online' to the answer 'online', making the logic sound |

|

|

. There are no other tags or concepts mentioned that could have influenced this answer, so the connection is clear and valid.", |

|

|

"logical": true |

|

|

} |

|

|

], |

|

|

[ |

|

|

{ |

|

|

"thought": "<thought>Given that the reasoning explicitly states 'mortgage for my home' and directly corresponds to the tag name 'mortgage', and the |

|

|

re's no mention of other financial products like online, card, cars, or insurance, it is logical to conclude that the answer 'mortgage' is correct. The con |

|

|

text provided supports this by not contradicting the reasoning.</thought>", |

|

|

"justification": "<justification>The reasoning clearly states a direct match between the customer's statement and the tag name 'mortgage'. There ar |

|

|

e no conflicting elements in the text, making the connection sound and valid. Therefore, it is logical that the answer 'mortgage' is relevant to the given |

|

|

context.</justification>", |

|

|

"logical": true |

|

|

} |

|

|

], |

|

|

[ |

|

|

{ |

|

|

"thought": "<thought>Given that the reasoning states there's a low interest rate mentioned and comparison to other cards, it logically follows that |

|

|

'card' would be an appropriate answer. The context, although incomplete, aligns with the reasoning as it pertains to card products.</thought>", |

|

|

"justification": "<justification>The reasoning correctly identifies the topic of discussion (cards) based on key phrases like 'low interest rate' a |

|

|

nd 'comparison to other cards'. Since the answer provided is 'card', which directly corresponds to this context, the logical connection between the reasoni |

|

|

ng and the answer is valid.</justification>", |

|

|

"logical": true |

|

|

} |

|

|

], |

|

|

[ |

|

|

{ |

|

|

"thought": "The reasoning states that the customer mentioned the mobile check deposit feature, which is related to online banking services. The con |

|

|

text provided a tag with id '0' named 'online', and the answer given is 'online'. This directly matches the content of the text, making it relevant.", |

|

|

"justification": "Since the context provides a clear connection between the customer's mention of mobile check deposit (related to online banking) |

|

|

and the tag 'online', the answer 'online' is logically derived from this reasoning. The direct match in terms of content makes the logical link valid and s |

|

|

ound.", |

|

|

"logical": true |

|

|

} |

|

|

], |

|

|

[ |

|

|

{ |

|

|

"thought": "<thought> The reasoning states that the context mentions 'premiums' and 'coverage', which are related to insurance. It also notes the p |

|

|

resence of an 'insurance' tag with id 4, suggesting this should be tagged as such. The answer provided is 'insurance', directly matching the reasoning's co |

|

|

nclusion. There is no mention in the text or reasoning that contradicts this.</thought>", |

|

|

"justification": "<justification> The reasoning and the answer are logically consistent because they both point to the same key term, 'insurance'. |

|

|

The presence of relevant terms like 'premiums' and 'coverage', along with the explicit tag reference, support a logical connection between the context and |

|

|

the answer. There is no indication that any other services or products mentioned in the reasoning (like online services, cards, cars, or mortgages) are pre |

|

|

sent in the text.</justification>", |

|

|

"logical": true |

|

|

} |

|

|

] |

|

|

] |

|

|

} |

|

|

``` |

|

|

Benefits of Multi Class Classification |

|

|

================== |

|

|

- Precision Decision-Making |

|

|

Automates complex categorization tasks (e.g., loan risk tiers, transaction types) with >90% accuracy, reducing human bias. |

|

|

|

|

|

- Operational Efficiency |

|

|

Processes 10,000+ transactions/cases per minute vs. hours manually (e.g., JP Morgan’s COiN platform reduced 360k loan doc hours to seconds). |

|

|

|

|

|

- Risk Mitigation |

|

|

Proactively flags 5+ fraud types (identity theft, money laundering) with 40% fewer false positives than rule-based systems. |

|

|

|

|

|

- Regulatory Compliance |

|

|

Auto-classifies documents for FINRA/SEC audits (e.g., Morgan Stanley uses NLP to categorize 3M+ annual communications into 50+ compliance buckets). |

|

|

""") |

|

|

|

|

|

with gr.Tab("Call Resolution"): |

|

|

gr.Markdown(""" |

|

|

Objective: Proactive Entity Mapping: Clarifying Critical Elements in Complex Call Analysis for Strategic Insight |

|

|

================================================ |

|

|

- Graph relationship between entity |

|

|

- summary of the interaction |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Content") |

|

|

out_product = gr.Textbox(label="Entity Resolution") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[""" |

|

|

Representative: "Thank you for calling Goldman Sachs Credit Card Services. My name is Sarah. May I have your full name and the last 4 digits of your card number for verification?" |

|

|

|

|

|

Customer: "This is Michael Chen, card ending 5402." |

|

|

|

|

|

Representative: "Thank you, Mr. Chen. I show you have an Apple Card account opened in 2023. How can I assist you today?" (Reference: Search Result Apple Card context) |

|

|

|

|

|

Customer: "I'm disputing a $329 charge from TechElectronics from March 15th. I never received the item." |

|

|

|

|

|

Representative: "I understand your concern. Let me initiate a dispute investigation. Per our process (Search Result BBB complaint handling): |

|

|

|

|

|

We'll apply a temporary credit within 24 hours |

|

|

|

|

|

Our team will contact the merchant |

|

|

|

|

|

You'll receive email updates at michael.chen@email.com |

|

|

|

|

|

Final resolution within 60 days |

|

|

|

|

|

Would you like me to proceed?" |

|

|

|

|

|

Customer: "Yes, but what if they fight it?" |

|

|

|

|

|

Representative: "If the merchant disputes your claim, we'll: |

|

|

|

|

|

Review all evidence using our 3-phase verification system (Search Result multi-stage investigation) |

|

|

|

|

|

Consider your purchase protection benefits |

|

|

|

|

|

Escalate to senior specialists if needed |

|

|

|

|

|

For security, never share your CVV (339) or full card number with callers. Always call back using the number on your physical card (Search Result scam warning)." |

|

|

|

|

|

Customer: "Can I make a partial payment on my balance while this is pending?" |

|

|

|

|

|

Representative: "Absolutely. We offer: |

|

|

"minimum_payment": "$35 due April 25", |

|

|

"hardship_program": "0% APR for 6 months", |

|

|

"custom_plan": "Split $600 balance over 3 months" |

|

|

Would you like to enroll in any of these?" |

|

|

|

|

|

Customer: "The 3-month plan, please." |

|

|

|

|

|

Representative: "Confirmed. Your next payment of $200 will process May 1st. A confirmation email with dispute case #GS-2025-0422-8830 is being sent now. Is there anything else?" |

|

|

|

|

|

Customer: "No, thank you." |

|

|

"""] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Resolve") |

|

|

btn_recommend.click(fn=resolve, inputs=in_verbatim, outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

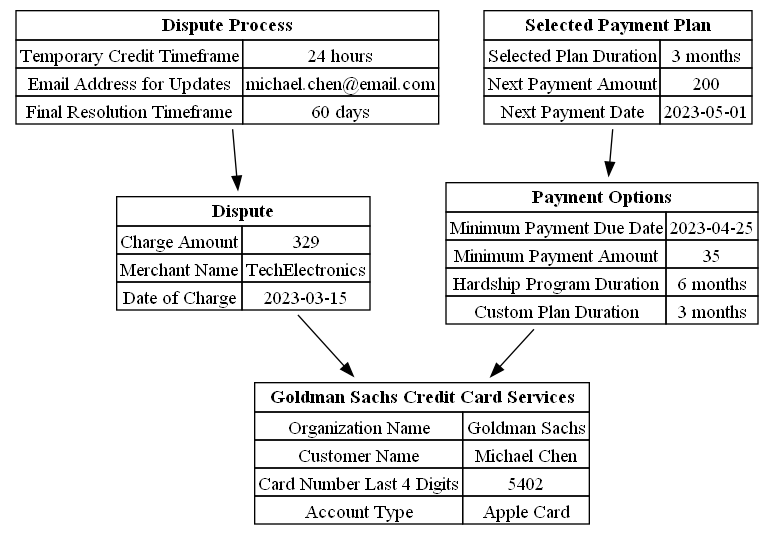

Example of Call Resolution |

|

|

=============== |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Resolution for Clear Picture about Customer Issue |

|

|

https://i.postimg.cc/J4qsDYtZ/entity.png |

|

|

|

|

|

Companies like RBC, Comcast, or BMO often face a recurring challenge: long, complex customer service calls filled with vague product references, overlapping account details, and unstructured issue descriptions. This makes it difficult for support teams and analytics engines to extract clear insights or resolve recurring pain points across accounts and products. |

|

|

|

|

|

#### How can teams automatically stitch together fragmented mentions of the same customer, product, or issue—across call transcripts, CRM records, and support tickets—to form a unified view of the actual problem? |

|

|

|

|

|

That's where Entity Resolution comes in. By linking related entities hidden across data silos and messy text (like "my internet box" = "ARRIS TG1682G" or "John Smith, J. Smith, and js456@gmail.com"), teams gain a clearer, contextual understanding of customer frustration in real-time. |

|

|

|

|

|

For example, Comcast reduced repeat service calls by 17% after deploying entity resolution models on long call transcripts—turning messy feedback into actionable product insights and faster resolutions. |

|

|

|

|

|

### The result? Less agent time lost, higher customer satisfaction, and data pipelines that actually speak human. |

|

|

""") |

|

|

with gr.Tab("Human Feedback Content"): |

|

|

gr.Markdown(""" |

|

|

Objective: Leveraging Human Feedback to Deliver Personalized Content that Proactively Solves Customer Pain Points |

|

|

================================================ |

|

|

- replace human with reward/penalty function, you will get RLHF by ranking the solutions |

|

|

""") |

|

|

|

|

|

in_verbatim = gr.Textbox(label="Persona") |

|

|

in_campaign = gr.Textbox(label="campaign") |

|

|

out_product = gr.Textbox(label="Your Personalized Email Campaign Bot") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

"""My mortgage was assumed by Bank of America when Countrywide mortgages ceased to do business. My mortgage increased without any explanation. When I inquired, they stumbled and gave me the run around. I’d NEVER do business with Bank of America again""", |

|

|

"MORT"], |

|

|

["my credit card limit is too low, I need a card with bigger limit and low fee", "CARD"] |

|

|

], |

|

|

[in_verbatim, in_campaign] |

|

|

) |

|

|

btn_recommend = gr.Button("Personalized Email") |

|

|

btn_recommend.click(fn=email, inputs=[in_verbatim, in_campaign, out_product], outputs=out_product) |

|

|

|

|

|

h_feedback = gr.Radio(['approved', 'rejected'], label="Human Feedback", info="Which campaign you want to approve?") |

|

|

h_campaign = gr.Textbox(label="campaign") |

|

|

btn_deliver = gr.Button("Deliver?") |

|

|

btn_deliver.click(fn=feedback, inputs=[h_feedback, h_campaign, out_product], outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

Human Feedback for Personalized Content enables brands like Mr. Cooper to analyze customer preferences and pain points, then deliver tailored solutions. By embedding real-time feedback loops, they created personalized mortgage-refinancing videos showcasing individual home equity data and financial goals, resulting in 18% higher engagement and 12% lower churn. |

|

|

|

|

|

#### Outcome: |

|

|

|

|

|

- Dynamic content adaptation based on behavioral data (e.g., Hilton Honors’ app reduced booking friction by 40% via predictive analytics) |

|

|

|

|

|

- Proactive problem-solving (e.g., Orangetheory Fitness used workout metrics to boost class attendance to 97%) |

|

|

|

|

|

- 52% faster ROI through AI-driven personalization scaling |

|

|

|

|

|

### Ready to turn customer frustrations into loyalty drivers with content that feels personally crafted? |

|

|

|

|

|

This approach aligns with best-in-class use cases where feedback-driven personalization drives measurable business growth |

|

|

""") |

|

|

|

|

|

with gr.Tab("RAG Recommender"): |

|

|

gr.Markdown(""" |

|

|

Objective: Dynamic RBC Product Recommender: Personalize Offers Using Customer Persona Insights |

|

|

================================================ |

|

|

- Retrieval: Public RBC Product Data, other massive dataset: customers data |

|

|

- Recommend: RBC Product |

|

|

|

|

|

##### __free tier hosting system limitation for this use case__ |

|

|

- cannot use any workable embedding model due to big size |

|

|

- this is not functioning correctly since I just replace embedding with a random matrix. |

|

|

- it will work under normal environment. |

|

|

|

|

|

##### Potential Optimization |

|

|

BM25 reranking using keyword |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Verbatim") |

|

|

out_product = gr.Textbox(label="Product") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

"Low APR and great customer service. I would highly recommend if you’re looking for a great credit card company and looking to rebuild your credit. I have had my credit limit increased annually and the annual fee is very low."] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Recommend (disabled due to embedding too big for download in huggingface)", interactive=False) |

|

|

btn_recommend.click(fn=rbc_product, inputs=in_verbatim, outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

Example Output |

|

|

=========== |

|

|

RBC Newcomer Mortgage |

|

|

|

|

|

Companies pour millions into product catalogs, marketing funnels, and user acquisition—yet many still face the same challenge: |

|

|

================== |

|

|

### 📉 Pain points: |

|

|

- High bounce rates and low conversion despite heavy traffic |

|

|

- Customers struggle to find relevant products on their own |

|

|

- One-size-fits-all promotions result in wasted ad spend and poor ROI |

|

|

|

|

|

### 🧩 The real question: |

|

|

What if your product catalog could *adapt itself* to each user in real time—just like your best salesperson would? |

|

|

|

|

|

### 🎯 The customer need: |

|

|

Businesses need a way to dynamically personalize product discovery, so every customer sees the most relevant items—without manually configuring hundreds of rules. |

|

|

|

|

|

## ✅ Enter: Product Recommender Systems |

|

|

|

|

|

By analyzing behavioral data, preferences, and historical purchases, a recommender engine surfaces what each user is most likely to want—boosting engagement and revenue. |

|

|

|

|

|

### 📌 Real-world use cases: |

|

|

- **Amazon** attributes up to 35% of its revenue to its recommender system, which tailors the home page, emails, and checkout cross-sells per user. |

|

|

- **Netflix** leverages personalized content recommendations to reduce churn and increase watch time—saving the company over $1B annually in retention value. |

|

|

- **Stitch Fix** uses machine learning-powered recommendations to curate clothing boxes tailored to individual style profiles—scaling personal styling. |

|

|

|

|

|

### 💡 Business benefits: |

|

|

- Higher conversion rates through relevant discovery |

|

|

- Increased average order value (AOV) via cross-sell and upsell |

|

|

- Improved retention and lower customer acquisition cost (CAC) |

|

|

|

|

|

If your product discovery experience isn’t working as hard as your marketing budget, it’s time to make your catalog intelligent—with recommendations that convert. |

|

|

""") |

|

|

|

|

|

with gr.Tab("Eval"): |

|

|

gr.Markdown(""" |

|

|

🏦 LLM Eval for Application Security in Personal Banking |

|

|

==================== |

|

|

What happens when your generative AI exposes customer data before you even launch? |

|

|

|

|

|

The push toward personalized digital experiences is powered by generative AI. But with that innovation comes a hidden risk: insecure prompt logic, hallucinated outputs, and untested model behavior can expose sensitive financial information—undermining customer trust and inviting regulatory scrutiny. |

|

|

|

|

|

### 🔒 LLM evaluations aren’t just a technical safeguard—they're a business enabler. By proactively identifying vulnerabilities in AI-generated content and application logic, LLM evals help teams launch secure, compliant personal banking apps. |

|

|

|

|

|

#### ✅ Outcome: At one Tier-1 Canadian bank, I built a cross-functional model risk pipeline that automated LLM testing—catching data leaks and unsafe outputs before deployment. The result: fewer post-launch incidents, smoother audits, and accelerated go-to-market timelines. |

|

|

https://postimg.cc/3WtG4ZK2 |

|

|

|

|

|

### Whether the goal is to reduce fraud, streamline compliance reviews, or optimize AI-generated product recommendations—LLM evals give business, risk, and engineering teams a shared lens on safety, explainability, and performance. |

|

|

|

|

|

How confident are you that your generative AI app won’t hallucinate its way into a privacy breach? |

|

|

""") |

|

|

|

|

|

with gr.Tab("PII Guardrail"): |

|

|

gr.Markdown(""" |

|

|

Objective: Automated PII Data Removal: Proactive Compliance & Risk Mitigation |

|

|

================================================ |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Peronal Info") |

|

|

out_product = gr.Textbox(label="PII") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

""" |

|

|

He Hua (Hua Hua) Director |

|

|

hehua@chengdu.com |

|

|

+86-28-83505513 |

|

|

|

|

|

Alternative Address Format: |

|

|

Xiongmao Ave West Section, Jinniu District (listed in some records as 610016 postcode) |

|

|

""" |

|

|

] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Mask PII") |

|

|

btn_recommend.click(fn=derisk, inputs=in_verbatim, outputs=out_product) |

|

|

gr.Markdown(""" |

|

|

Example Output |

|

|

========= |

|

|

GUARDRAILED: |

|

|

He Hua (<PERSON>) Director |

|

|

hehua@chengdu.com |

|

|

<PHONE_NUMBER> |

|

|

|

|

|

Alternative Address Format: |

|

|

Xiongmao Ave West Section, Jinniu District (listed in some records as 610016 postcode) |

|

|

|

|

|

|

|

|

Best Viewing: Before 9:00 AM during summer hours (7:30 AM-5:00 PM) |

|

|

|

|

|

Caretaker: <Caretaker_0>"Grandpa <PERSON>") |

|

|

|

|

|

Additional Contacts |

|

|

Charitable Donations: <PHONE_NUMBER> |

|

|

Dining Reservations: <PHONE_NUMBER> |

|

|

|

|

|

"Is your personal banking AI trained on customer conversations—or customer identities?" |

|

|

=========== |

|

|

At RBC, generative AI is transforming personal banking—from real-time support to automated financial advice. But the same customer data powering these insights can expose the bank to regulatory violations, data breaches, and biased models—especially when names, emails, and phone numbers slip through into training or inference pipelines. |

|

|

|

|

|

### 🔍 Entity removal solves this by automatically detecting and anonymizing personal identifiers before data is used for training, fine-tuning, or analysis. |

|

|

|

|

|

#### ✅ Outcome: In one internal audit scenario, a Tier-1 bank uncovered PII exposure in over 12% of its chatbot training data. By integrating entity removal, the bank reduced privacy risk, aligned with GDPR and CPPA compliance—and increased the usable volume of safe, structured text by 35%. |

|

|

|

|

|

### The benefits go beyond compliance: |

|

|

- Reduce financial crime by safely leveraging more chat logs and support tickets to train fraud detection systems without compromising privacy. |

|

|

|

|

|

- Optimize internal processes by focusing NLP models on customer intent rather than noisy identifiers. |

|

|

|

|

|

- Boost revenue by extracting clean, actionable signals from anonymized product inquiries and complaints—fueling more accurate product recommendations. |

|

|

|

|

|

Are your AI systems learning from customer insights—or leaking customer identities in the process? |

|

|

""") |

|

|

|

|

|

demo.launch(allowed_paths=["."]) |

|

|

|